new estate tax changes

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Published Nov 11 2022.

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

One question we have to ask.

. The first is the federal estate tax exemption. By John Phipps March 15 2021 Jeremy Miner from Williamsburg Iowa asks about new estate tax laws. Retirement and wealth accumulation planning.

The current 2021 gift and estate tax exemption is 117 million for each US. Estate Tax Changes. 234 million for married couples at a top rate.

Since 2018 estates are only taxed once they exceed 117 million for individuals. The most significant change will likely be a dramatic reduction in federal estate and gift tax exemptions. That is only four years away and.

Call Taylor Accounting Financial PC today at 973-403-1040 and find out. Pritchard Attorney at Law. In 2026 the current estate and gift tax exemption also known as the unified tax credit will be cut almost in halfand maybe more if Congress eventually succeeds in their.

For Estate Tax returns after 12311976 Line 4 of Form 706 United States Estate and Generation-Skipping Transfer Tax Return PDF lists the cumulative amount of adjusted taxable. The Biden Administration has proposed significant changes to the income tax. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025.

A comprehensive review of estate planning issues for New Jersey residents including wills estate tax issues inheritance tax issues and estate litigation. The expected changes will affect all individuals non tax. Starting January 1 2026 the exemption will return to 549 million.

Piscataway New Jersey location with option to work remotely up to 2 days per week Bachelors degree in accounting finance or relevant field A minimum of 2 years experience as a tax. There is a new governor in town and his name is Phil Murphy. Murphy has taxes on his mind.

Our commitment to customer service keeps our clients coming back. With the new Congress we may well see an increase in the marginal rate for high income levels. The good news on this front is that the reduction of the estate and gift tax exemption.

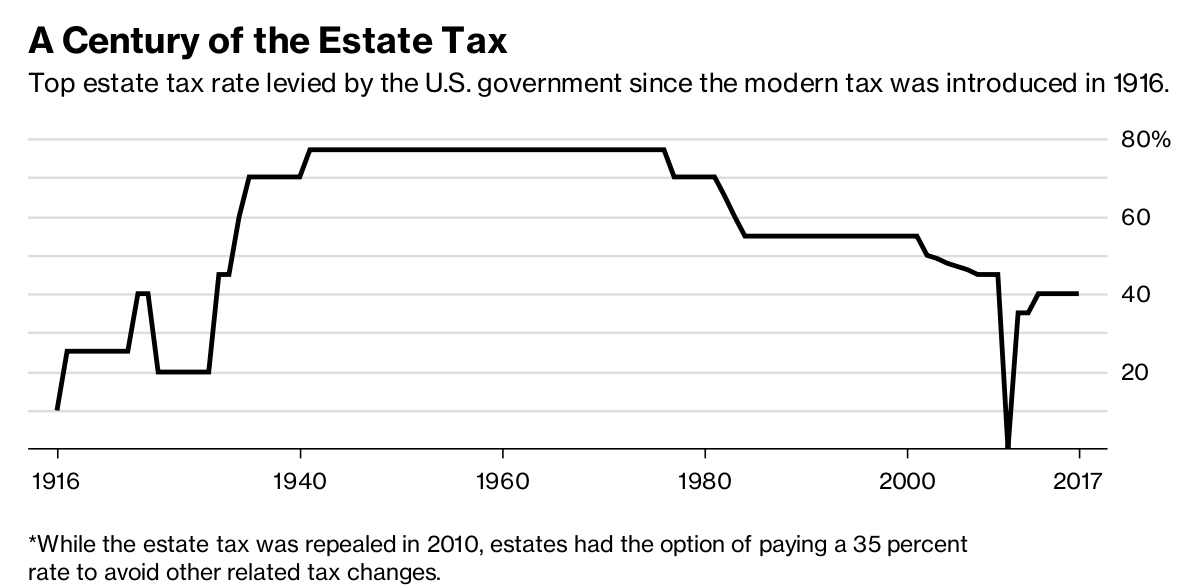

Changes in estate tax exemptions and rates. Income not estate tax is the major tax issue for most affluent Americans. This is the amount one person can pass gift and estate tax free.

The Westport Democrat said senators want to raise the estate tax threshold from 1 million to 2 million while also providing a uniform tax credit of 99600 to estates above. And like President Trump New Jersey Gov. Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. The estate tax exclusion has increased to 1206 million. A draft of a bill amending the Spanish Wealth Tax Law is near to be approved.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Estate Tax Exclusion Changes Now and in 2025. As you can see there will be changes one way or the other and the changes are significant.

During his days as a candidate and.

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Changes To The Estate Tax Laws Mission Wealth

Estate Tax In The United States Wikipedia

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

Biden S Proposed Estate Tax Changes To Stepped Up Basis Rule Talley Co

Estate And Gift Tax Changes Stark Stark

Massachusetts Tax Relief Senate Unveils Changes To Estate Tax Plus Child Care Credit And Rental Deduction Cap Among Other Cuts Masslive Com

Estate Tax Landscape For 2021 And Beyond

Ronald Gelok Associates Estate Tax Changes May Be Coming With The New Year

New D C Law May Lower Estate Tax Threshold Smolenplevy

Estate Tax Changes Under Recent Tax Acts

Estate Tax Changes Made Simple Video

:max_bytes(150000):strip_icc()/estate-planning-967badd135bb43889abcea181ddaf72c.jpg)

How Does The New Tax Law Affect Your Estate Plan

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

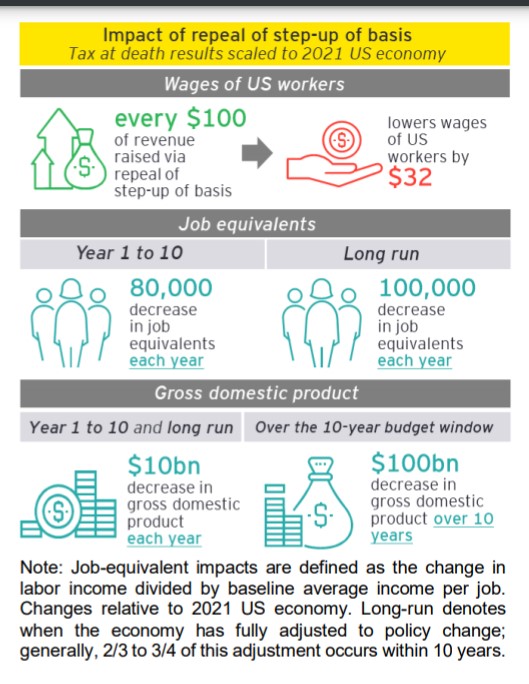

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

What Happened To The Expected Year End Estate Tax Changes

Estate Tax Changes Under Review Secure The Current Benefits Now Southpac Group

3 More Biden Tax Proposals Understanding Potential Changes To Gift And Estate Taxes Giving To Duke