can you tax a service fee

Tax service fees exist because lenders want to protect their access to collateral if a borrower defaults. If you sell service contracts separately or in tandem with sales of tangible goods you may be liable to collect sales tax.

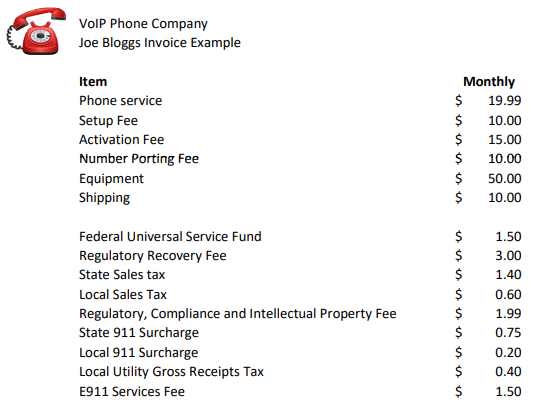

Voip Pricing Taxes And Regulatory Fees Explained

The purpose of the state sales tax service fee is to assist.

/TermDefinitions_ExciseTax_V1_CT-1f91c5d39a89489081cbf73a47af61d0.jpg)

. An optional payment designated as a tip gratuity or service charge is not subject to tax. 18 service fee 18 of 63 1134 6 sales tax 6 of 63 378 Total cost per person7812 So I guess the short answer is no our service fee is not taxed. When a service provider bundles internet access with a taxable service such as telecommunications service or cable television service the service provider should not.

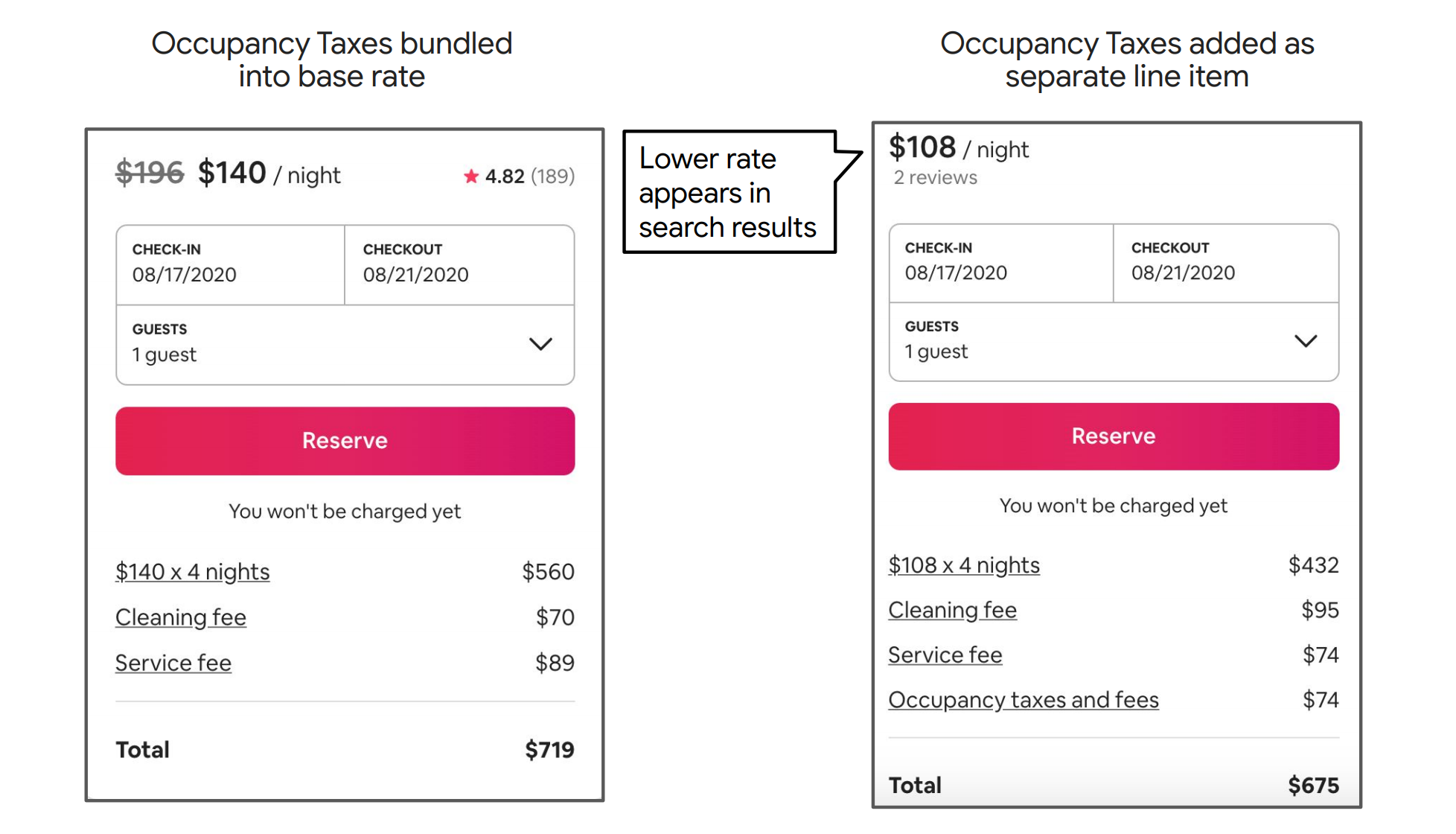

While property taxes are generally tax-deductible this years deduction is limited to a total of 10000 which includes state and local income taxes as well as sales taxes paid. While Hawaii New Mexico and South Dakota generally tax all sales. So a tip for those of you planning a wedding and getting quotes.

For example if the lender is charging the Veteran purchaser an Origination Fee of 5 then unallowable. After 11302022 TurboTax Live Full Service customers will be able to amend their. Ask for the all inclusive amount that includes venue rental food beverage labor staff tax and service charge.

Because some employers keep a portion of service charges the IRS considers. Fees for services performed by attorneys or trustees who are salaried members of the Mortgagees staff. Unlike many other states California does not tax services unless they are an integral part of a taxable transfer of property.

After all if a borrower isnt paying his property taxes its probably only a. As you can read from the above tax service fees are not permitted to be. A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time.

Borrowers do not directly benefit from the tax service and lenders may not pass their charges on to borrowers. In the state of Massachusetts services are not usually taxable. When it comes to sales tax the general rule of thumb has always been products are taxable while.

An optional payment designated as a tip gratuity or service charge is not subject to tax. A 1000 bill with a 20-percent. While most services are exempt there are a few exceptions.

Tax Service fees are an example of an unallowable charge. Sales Tax Fundamentals. You can deduct your tax preparation fees whether you pay to prepare your taxes once a year or pay quarterly taxes.

The seller or lender must pay the non-allowable tax service. Of the 23 charge the hotel pays its wait staff. Get up to speed on the basics of sales tax.

Delaware Hawaii New Mexico and South Dakota tax most services. Still others like Texas and Minnesota are actively expanding service taxability. A hotel charges a 23 gratuity on all banquets held at the hotel.

However the service charge is subject to sales tax. For example a service whos work includes creating or. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

Businesses that sell services across. A mandatory payment designated as a tip gratuity or service charge is included in taxable. The law does not specifically name most services as exempt but.

Cell Phone Tax Wireless Taxes Fees Tax Foundation

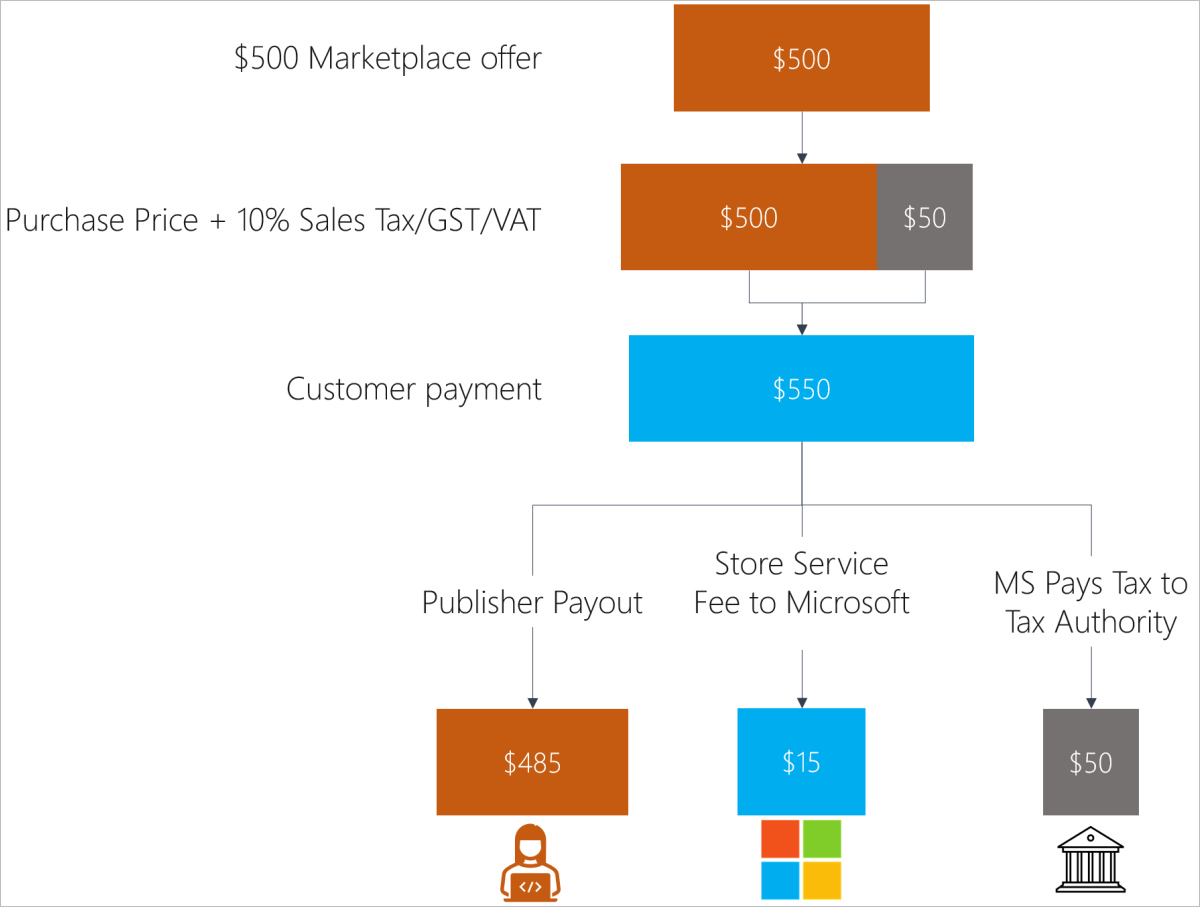

How Tax Policies Affect Payout For Azure Marketplace Partner Center Microsoft Learn

Tax Prep Service Looks To Lower Fees In Market That Charges Hundreds For Tax Preparation Services

/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)

How Much Is Too Much To Pay For Tax Returns

3 Reasons You Should Switch To Using Airbnb Pass Through Taxes Bluetent

How To Charge Your Customers The Correct Sales Tax Rates

Average Income Tax Preparation Fees Guide How Much Does It Cost To Get Your Taxes Done Tax Services Fees Average Cost Of Tax Preparation Advisoryhq

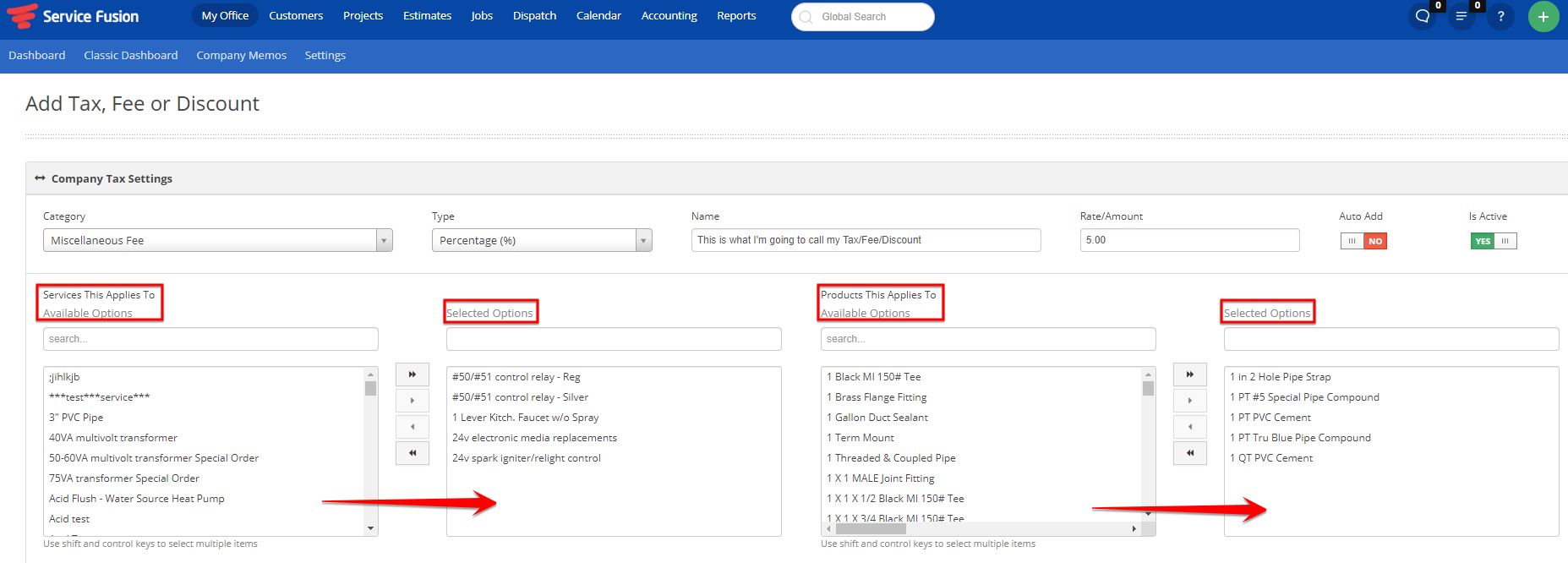

How To Setup Taxes Fees And Discounts Article Video Service Fusion

Some Spokane Restaurants Turning To Flat Service Fees Instead Of Tips The Spokesman Review

Additional Fees Taxes Anyroad Help Center

Tax Estimator Florida Surplus Lines Service Office

Sales Tax Laws By State Ultimate Guide For Business Owners

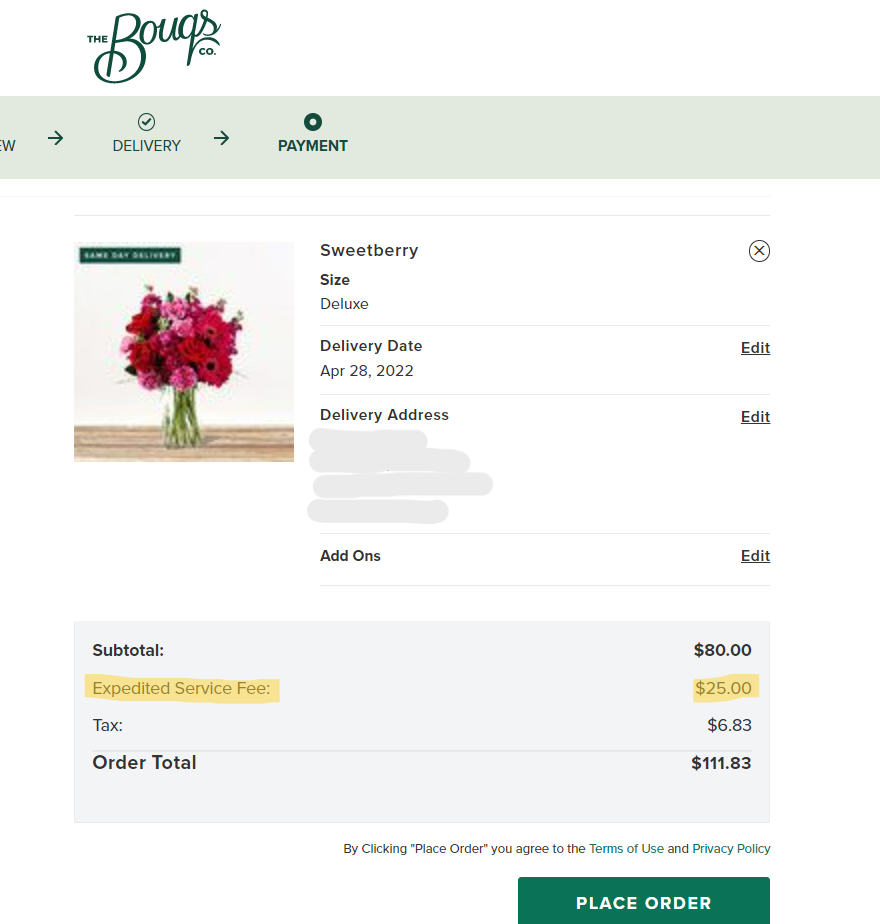

Why Was I Charged An Expedited Service Fee The Bouqs

/TermDefinitions_ExciseTax_V1_CT-1f91c5d39a89489081cbf73a47af61d0.jpg)

Excise Tax What It Is And How It Works With Examples

Checkout Customer Service Fee Scenarios Prior Releases Exatouch Knowledge Base